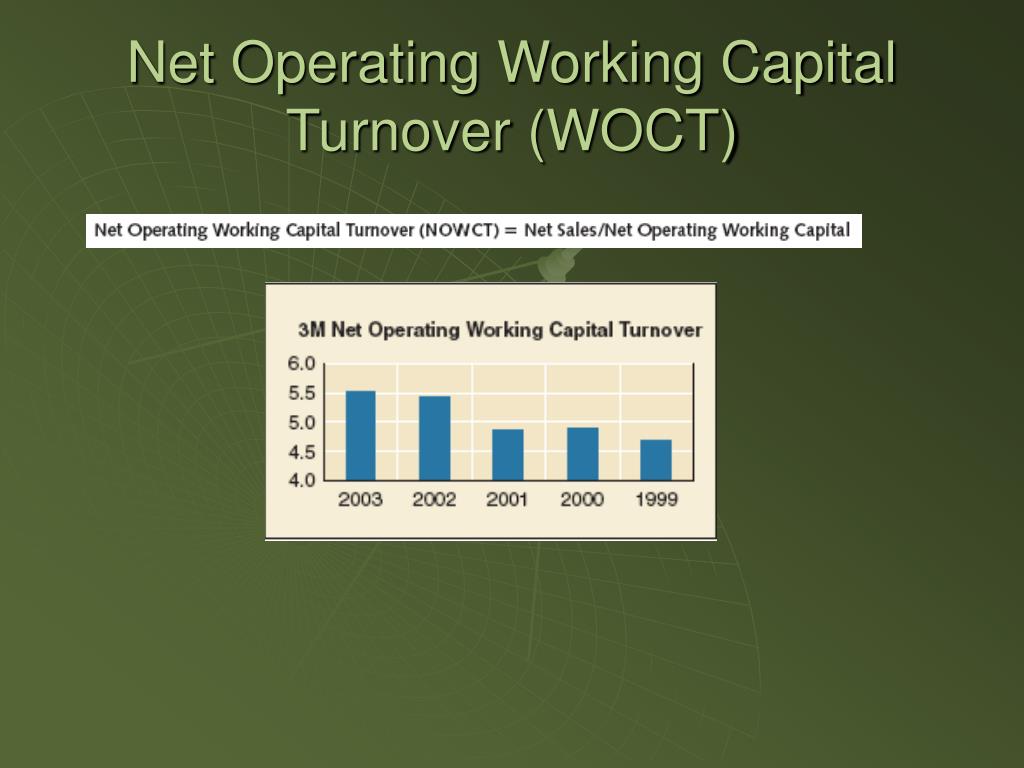

net operating working capital turnover

Net operating working capital is equal tooperating current assets less operating current liabilities. In essence the net working capital is the current assets less the current.

Ppt Financial Analysis Powerpoint Presentation Free Download Id 638693

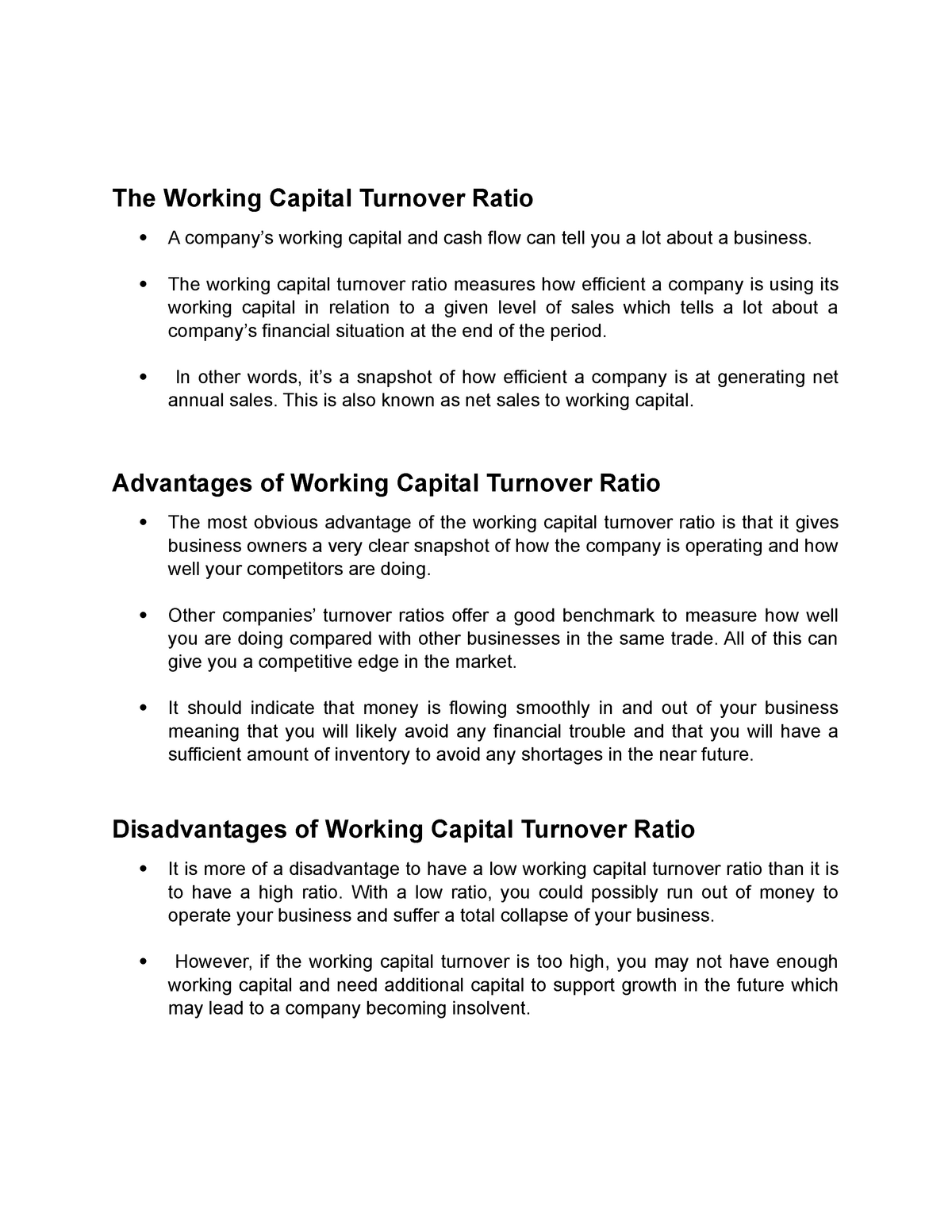

The working capital turnover ratio is calculated by dividing net annual sales by the average amount of working capitalcurrent assets minus current liabilitiesduring the.

. Working Capital Current Assets Current Liabilities. Net Sales 150000. Net working capital turnover is the percentage of net working capital allocated to a firms expenses that goes into net operating income.

The working capital turnover ratio is calculated as follows. It shows companys efficiency in generating sales revenue using total. Net operating working capitalis an asset that.

Net Working Capital NWC is not the same thing as the Net Operating Working Capital NOWC. One way to calculate NOWC is. What Is Working Capital Turnover.

It is also called investment. Working capital turnover Net sales Working capital Working capital turnover 500000 375000 Working capital turnover 13. NOWC is used to calculate the cash flow of a company and reveals current assets that a company can expect to turn into cash within 12 months.

There was a small decrease. This indicator shows the value in percentage terms about how many times the net invested operating capital NOIC is turned due to sales total invoiced. Turnover average current.

The working capital turnover is calculated by taking a companys net sales and dividing them by its working capital. Net Operating Working Capital Turnover. Example of Working Capital.

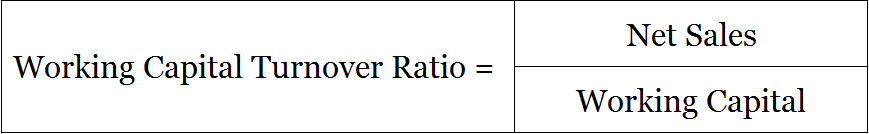

It is also an activity. WC 100000 50000. Working Capital Turnover Net Sales Net Working Capital NWC The sales of a business are reported on its income statement which tracks activity over a period of time.

Operating Current Assets 25 million 40 million. Working Capital Turnover Ratio Net SalesWorking. Working capital turnover refers to a ratio providing insights as to the efficiency of a companys use of its working capital to run the.

In this formula the working capital is calculated by subtracting a companys current liabilities from its current. By calculating the sum of each side the following values represent the two inputs required in the operating working capital formula. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of.

Net Working Capital Turnover ratio is the turnover divided by the net current assets or net working capital of the company. Working capital turnover ratio is computed by dividing the net sales by average working capital. Working capital turnover is a ratio that measures how efficiently a company is usinWorking capital turnover measures how effective a business is at generating saA higher working capital turnover ratio is better and indicates that a company is ablHowever if working capital turnover rises too high it could suggest tha See more.

Net annual sales divided by the average amount of working capital during the same year. Net working capital is less than net. The working capital turnover ratio is an accounting ratio that determines how effectively a business utilises its working capital to generate revenue.

Working capital turnover Net annual sales Working capital. Since net sales cannot be negative the turnover ratio. Example of the Working Capital Turnover Ratio.

The formula is the following.

The Working Capital Turnover Ratio Core Accounting Principles Statement Of Cash Flows Direct Studocu

What Is Working Capital Turnover Ratio Accounting Capital

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Mudranka

What Is The Working Capital Turnover Ratio And How Is It Calculated

Prepare A Common Size Balance Sheet Of Kj Ltd From The Following Information Particularsnote No 31 3 2017 Rs 31 3 2016 Rs I Equity And Liabilities 1 Shareholder S Funds 8 00 000 4 00 000 2 Non Current Liabilites 5 00 000

Working Capital Requirement Wcr Agicap

Ratio Analysis Of Bmw Pdf Revenue Equity Finance

Differences In Working Capital Among Farms Farmdoc Daily

Financial Strategic Value Creation 101 For Technologists

Working Capital Turnover Ratio Formula Example And Interpretation

Means For Working Capital Turnover Download High Resolution Scientific Diagram

Working Capital Turnover What It Is And How It Works Overview

Operating Working Capital Owc Formula And Calculation

Compute Working Capital Ratio From The Following Information Cash Revenue From Operations Rs 1 30 000 Credit Revenue From Operations Rs Accountancy Accounting Ratios 7344005 Meritnation Com

Chkpt 3 Financial Accounting Exam Flashcards Quizlet

From The Following Particulars Calculate A Net Asset Turnover Ratio B Fixed Asset Turnover Ratio C Working Capital Turnover Ratio Sarthaks Econnect Largest Online Education Community

Working Capital Turnover Ratio What It Is And How To Calculate It Planergy Software